do i have to pay estimated taxes for 2020

You can ignore them. The price of not making estimated tax payments when youre required to is a penalty.

Estimated Tax Payments For Independent Contractors A Complete Guide

Find a Local Tax Pro.

. If you earn at least two-thirds of your gross income from farming or fishing you do not have to make payments by the dates above. Your September payment and. Like if you took a IRA or 401K Withdrawal or had a big stock gain.

When tax filing time rolls around you have already paid your approximate tax liability. 90 of the tax to be shown on your 2020 tax return or. Generally if you owe 1000 or more in state and county tax for the year thats not covered by withholding taxes you need to make estimated tax payments throughout the year.

Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual. Instead you should do either of the following. Paying estimated quarterly taxes four times per year may seem like a chore.

Enter your financial details to calculate your taxes. You expect to owe at least 1000 in tax for 2020 after subtracting your withholding and refundable credits. But if you have no idea how much youll earn next year you can pay 100 percent of your 2020 tax bill to protect yourself from owing penalties and interest.

You probably have to pay estimated taxes if you file as a self-employed individual a sole proprietor a partnership or an S corporation shareholder. Citizen or resident alien for the entire tax year. In this guide well show you how to calculate and pay your federal estimated quarterly taxes and walk you through an.

Do I need to pay estimated taxes. However if you dont have taxes withheld from your income or if you dont have enough tax withheld from your income you may owe a penalty for underpaying estimated tax. You are required to pay estimated income tax if the tax shown due on your return reduced by your North Carolina tax withheld and allowable tax credits is 1000 or more regardless of the amount of income you have that is not subject to withholding.

You expect your withholding and refundable credits to be less than the smaller of. For information about nonresidents or dual-status aliens please see International. July 8 2020 908 AM It depends.

An individual is making joint estimated tax payments on a calendar-year basis. The tool is designed for taxpayers who were US. The federal income tax system is progressive so the rate of taxation increases as income increases.

Wednesday July 15th 2020. Citizens or resident aliens for the entire tax year for which theyre inquiring. You will still have to make your third estimated tax payment by Sept.

Who has to pay estimated taxes. Freelancers contractors and others whose earnings are reported on a 1099 instead of a W-2 also need to pay estimated taxes. The rule is that you must pay your taxes as you go.

You can if youd like but it isnt necessary. That depends on your situation. Due Dates for 2020 Estimated Quarterly Tax Payments.

Wednesday July 15th 2020 extended from April 15th 2020 due to the coronavirus Q2. An estimate of your 2022 income. 15 and your last payment will still be due on Jan.

To avoid a penalty your estimated tax payments plus your withholding and refundable credits must equal any of these. But if you project these quarterly payments correctly it can actually soften your tax burden. If married the spouse must also have been a US.

They are optional to pay. They dont get sent in with your tax return so the IRS wont be expecting them. Guide to paying IRS quarterly estimated tax payments.

If income will be greater or less than initially estimated the estimated tax payment should be adjusted. Pay all of your estimated tax for the 2019 tax year by January. You must make estimated payments if the expected tax due on your taxable income not subject to withholding is more than 400.

Income in America is taxed by the federal government most state governments and many local governments. They might have printed out if you got a big one time increase in income. Marginal tax rates range from 10 to 37.

2 They may file the income tax return and pay the tax in full on or before March 1 of the year following the tax year. You calculate that you need to pay 10000 in estimated taxes throughout the year and you dont make your first payment until June 15 when the second estimate is due so your first payment will be 5000. Turbo Tax was very conservative and doesnt want you to owe next year.

How much to pay when payments are due and the various payment options available to pay. The penalty amount depends on prevailing interest rates and how much estimated tax you should have paid. ϻis it true do I need to pay estimated taxes for 2020.

In most cases you must pay estimated tax for 2020 if both of the following apply. If at filing time you have not paid enough income taxes through withholding or quarterly estimated payments you may have to pay a penalty for underpayment. 90 of your current years original tax liability 667 if you are a farmer or commercial fisherman 100 of your prior years total tax liability 110 if your federal adjusted gross income is more than 150000.

Why you might not want to. Generally you need to pay at least 80 of your annual income tax liability before you file your return for the year through withholding or by making estimated tax payments on any income not subject to withholding.

When Are Taxes Due In 2022 Forbes Advisor

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Estimated Tax Payments Youtube

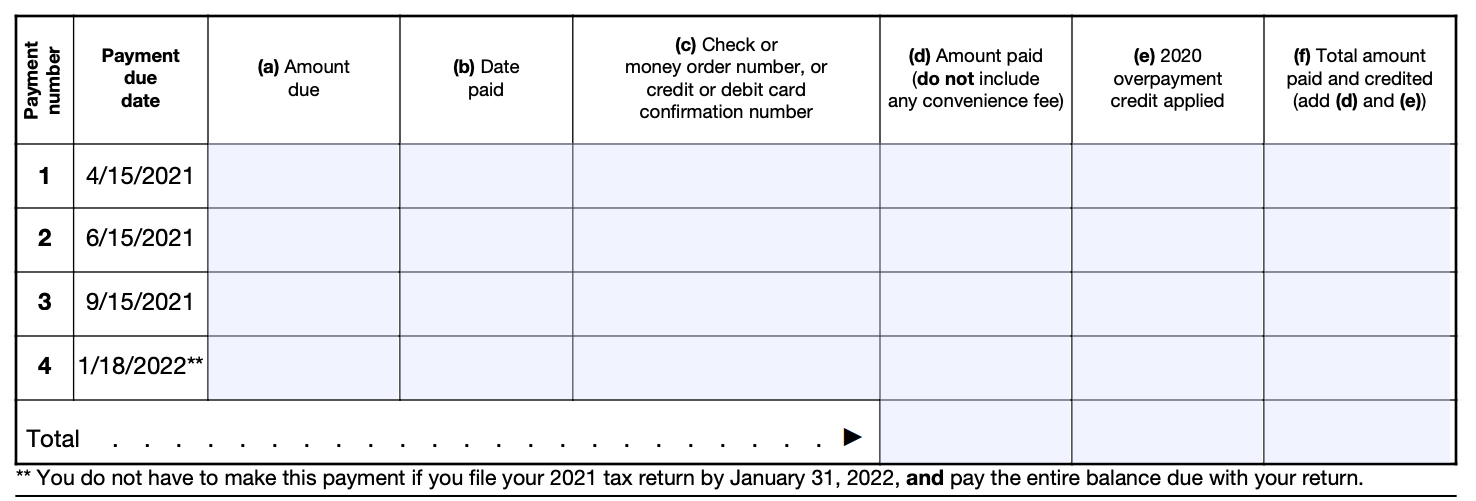

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

Safe Harbor For Underpaying Estimated Tax H R Block

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard

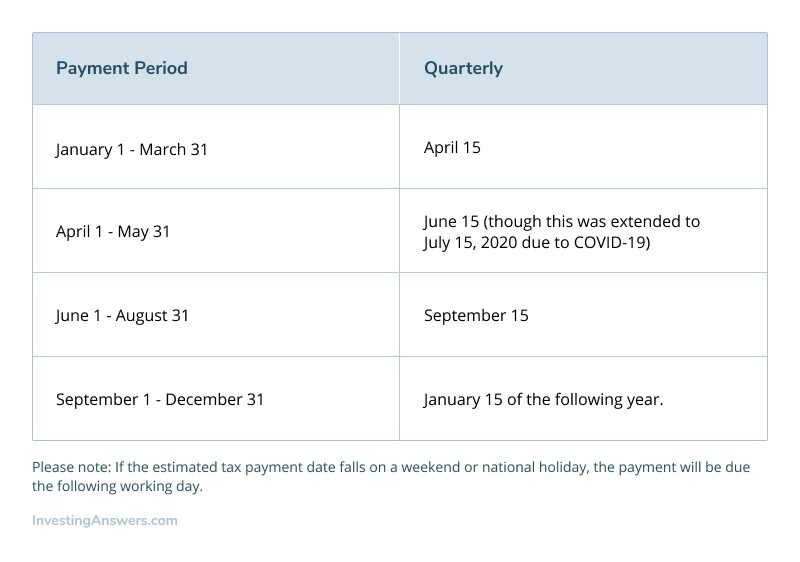

Fiscal Quarters Q1 Q2 Q3 Q4 Investinganswers

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard

How Much Does A Small Business Pay In Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download